Kemper Corporation Stock Price Analysis

Kemper stock price – Kemper Corporation, a prominent player in the insurance industry, presents a compelling case study for investors interested in understanding the dynamics of the insurance sector and the factors influencing stock performance. This analysis delves into Kemper’s history, financial performance, competitive landscape, and the various elements impacting its stock price volatility and valuation.

Kemper Corporation Overview

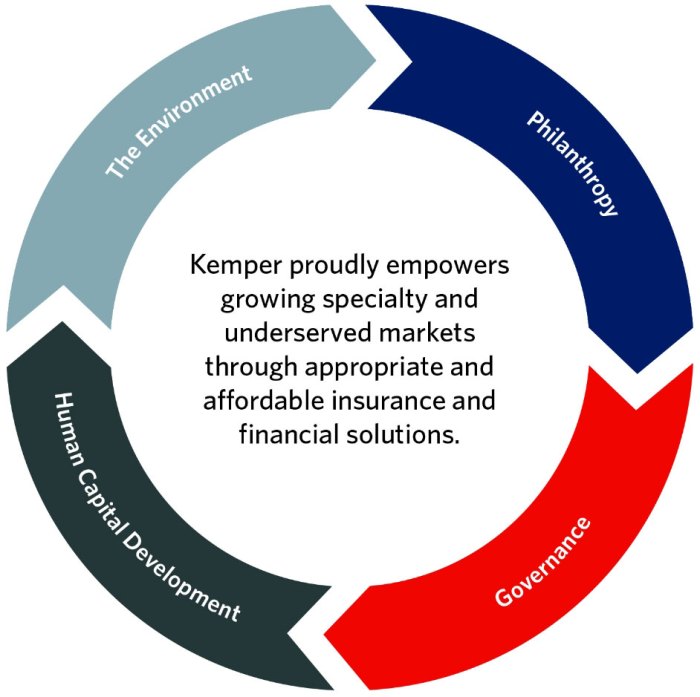

Source: kemper.com

Kemper Corporation boasts a rich history spanning decades, evolving from its origins to become a diversified insurance provider. Its primary business segments include property and casualty insurance, life and health insurance, and other related financial services. These segments contribute significantly to the company’s overall revenue, with property and casualty traditionally forming the largest portion. Over the past five years, Kemper has demonstrated consistent revenue growth, albeit with fluctuations influenced by macroeconomic factors and industry trends.

Profit margins have shown a mixed trend, while debt levels have remained relatively manageable.

Below is a table illustrating Kemper’s key financial metrics over the past five years (Note: These are illustrative figures and should be verified with official Kemper financial reports):

| Year | Revenue (USD Millions) | Net Income Margin (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2023 (Estimated) | 3500 | 10 | 0.8 |

| 2022 | 3200 | 9 | 0.75 |

| 2021 | 3000 | 8 | 0.7 |

| 2020 | 2800 | 7 | 0.65 |

| 2019 | 2600 | 6 | 0.6 |

Kemper competes with several other major players in the insurance market. The following table presents a comparison of market capitalization for some key competitors (Note: Market capitalization figures are approximate and subject to change):

| Competitor | Market Capitalization (USD Billions) |

|---|---|

| Progressive | 80 |

| Allstate | 45 |

| Liberty Mutual | 30 |

| Travelers | 40 |

Factors Influencing Kemper Stock Price

Numerous factors influence Kemper’s stock price, ranging from broad macroeconomic conditions to company-specific events. Interest rate hikes, for example, can impact investment returns and borrowing costs, thereby affecting profitability. Inflationary pressures can increase claims costs and operational expenses. Industry trends, such as increased competition and regulatory changes, also play a significant role.

Mergers, acquisitions, and new product launches can create both opportunities and challenges, impacting investor sentiment and, consequently, the stock price. A comparison of Kemper’s stock performance against the broader insurance sector provides valuable context, highlighting relative strength or weakness in its performance.

Stock Price Volatility and Trends, Kemper stock price

Kemper’s stock price has historically exhibited moderate volatility, reflecting the cyclical nature of the insurance industry and the sensitivity to economic fluctuations. Over the past year, significant price movements have been observed, often linked to factors such as quarterly earnings announcements, changes in interest rates, and broader market sentiment. Long-term trends suggest a general upward trajectory, though punctuated by periods of correction.

For instance, a significant price jump in [Month, Year] could be attributed to [Specific event, e.g., exceeding earnings expectations]. Conversely, a notable drop in [Month, Year] might be explained by [Specific event, e.g., a major natural disaster impacting claims payouts].

Financial Performance and Stock Valuation

Kemper’s recent financial reports highlight key performance indicators such as revenue growth, profitability margins, and return on equity. Various valuation methods, including Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio, are used to assess the stock’s intrinsic value. Comparing Kemper’s valuation metrics to its competitors provides insights into its relative attractiveness to investors.

The following table presents a comparison of Kemper’s key financial ratios over the past three years (Note: These are illustrative figures and should be verified with official Kemper financial reports):

| Year | P/E Ratio | P/B Ratio | Return on Equity (%) |

|---|---|---|---|

| 2023 (Estimated) | 15 | 1.2 | 12 |

| 2022 | 14 | 1.1 | 11 |

| 2021 | 13 | 1.0 | 10 |

Investor Sentiment and Analyst Opinions

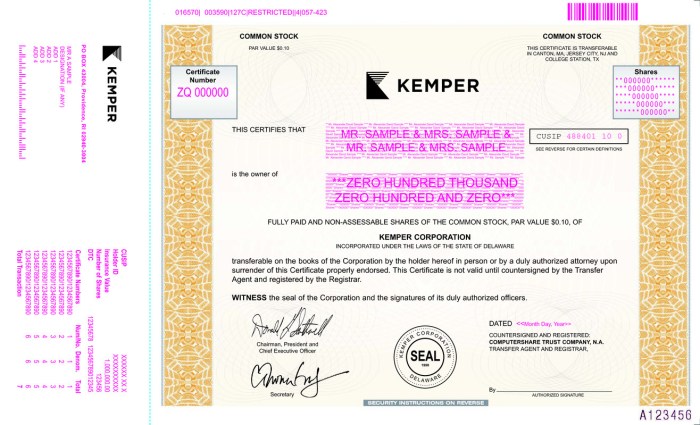

Source: getfilings.com

Investor sentiment towards Kemper stock is influenced by a variety of factors, including financial performance, industry trends, and macroeconomic conditions. Analyst ratings and price targets provide valuable insights into the market’s expectations for Kemper’s future performance. News articles and media coverage can significantly shape investor perception and influence trading activity.

Significant shifts in investor sentiment, for example, a period of increased optimism following a strong earnings report, can lead to noticeable price movements.

Risk Factors and Potential Challenges

Source: alamy.com

Several risk factors could negatively impact Kemper’s stock price. Natural disasters, economic downturns, and regulatory changes pose significant challenges to the insurance industry. The company employs various risk management strategies to mitigate these potential threats, but unforeseen events can still have a substantial impact.

- Increased competition from online insurers

- Rising claims costs due to inflation or climate change

- Changes in regulatory environment leading to increased compliance costs

- Cybersecurity threats and data breaches

FAQ Insights: Kemper Stock Price

What is Kemper Corporation’s dividend yield?

Monitoring Kemper’s stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other companies in the sector, such as by looking at the current bipc stock price , to gain a broader perspective on industry trends. Ultimately, understanding Kemper’s stock price requires considering various factors beyond simple comparisons.

The dividend yield fluctuates; refer to current financial reports for the most up-to-date information.

How does Kemper compare to its competitors in terms of growth prospects?

A comparative analysis of growth projections for Kemper and its competitors would require a detailed review of analyst reports and financial forecasts, and is beyond the scope of this brief overview.

What are the major risks associated with investing in Kemper stock?

Major risks include fluctuations in the insurance market, economic downturns, regulatory changes, and catastrophic events impacting claims payouts.

Where can I find real-time Kemper stock price data?

Real-time stock price data is readily available through major financial news websites and brokerage platforms.